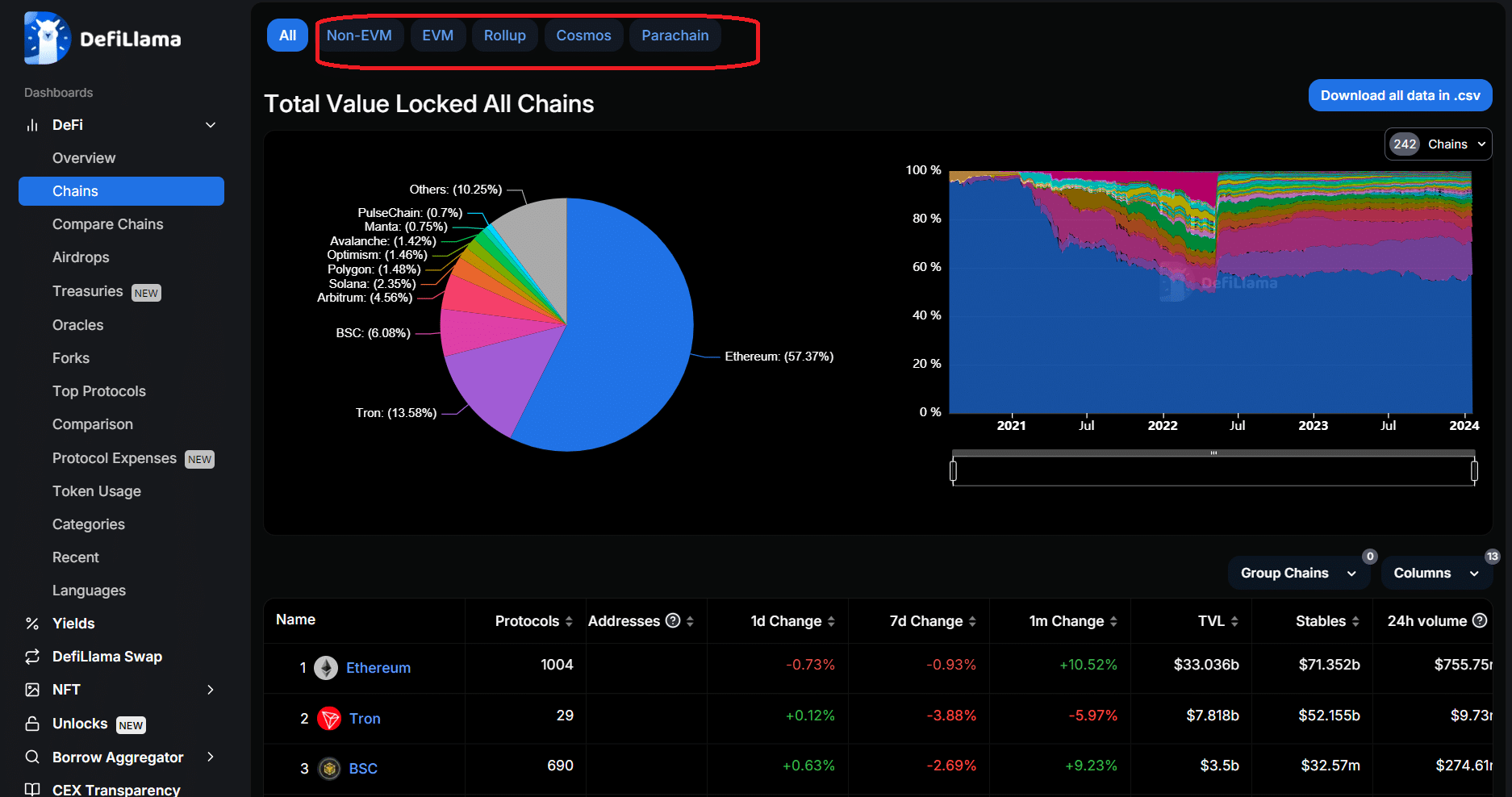

Decentralized Finance (DeFi) vaults have become a cornerstone of automated on-chain asset management, attracting a surge of capital as investors chase yield and DAOs seek scalable treasury solutions. In just twelve months, DeFi vaults’ Total Value Locked (TVL) has skyrocketed from less than $150 million in June 2024 to over $4.4 billion by June 2025. This explosive growth is a testament to the appetite for transparent, programmable financial tools – but it also magnifies the need for robust security and trust mechanisms.

What Makes a DeFi Vault “Battle-Tested”?

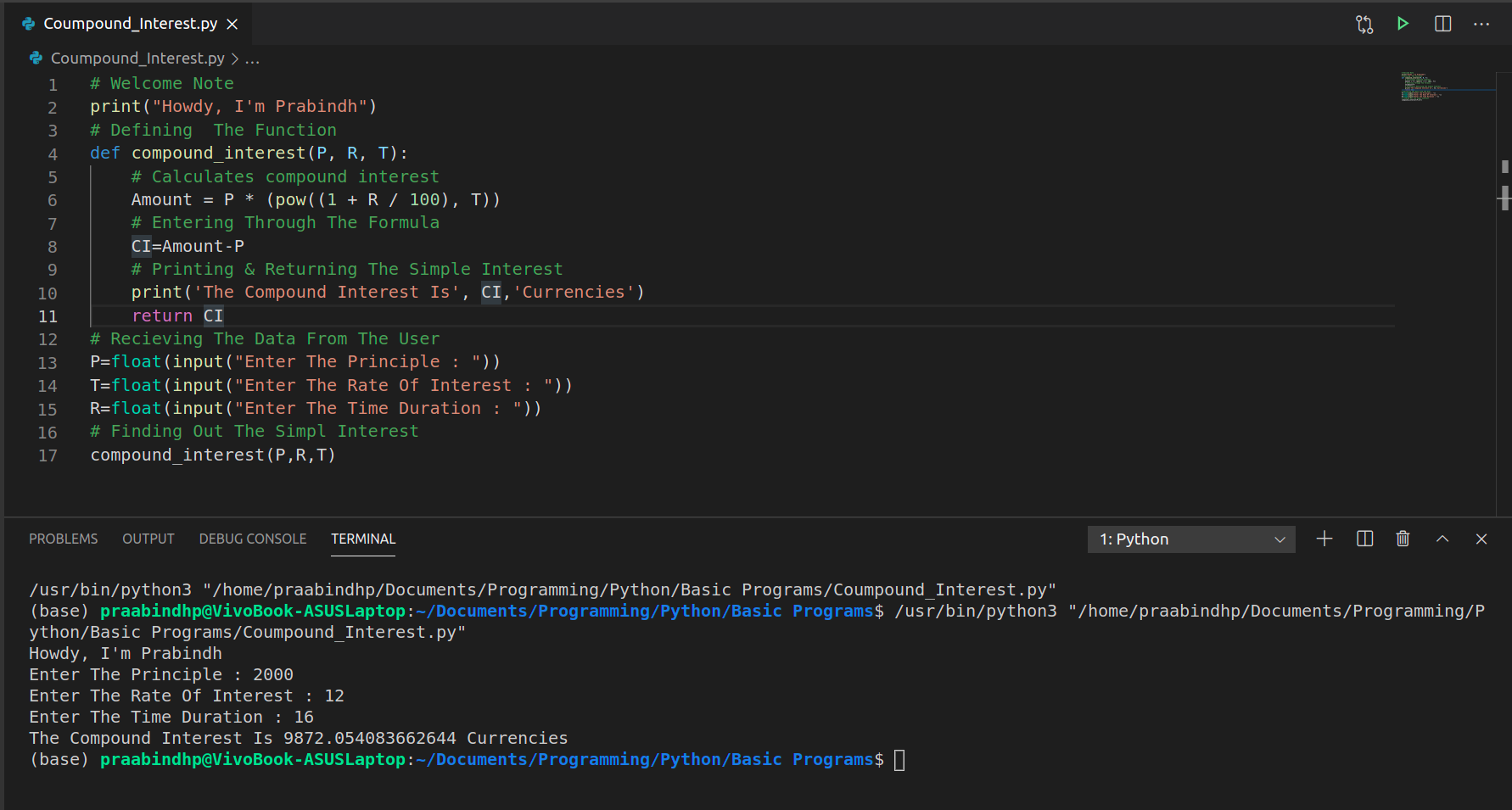

At their core, audited DeFi vaults are automated smart contract systems designed to execute yield strategies on behalf of users or treasuries. These contracts pool deposits and interact with protocols across the blockchain ecosystem, deploying capital into lending markets, liquidity pools, or structured products. The promise? Automated risk management and optimized returns – all governed by code rather than centralized intermediaries.

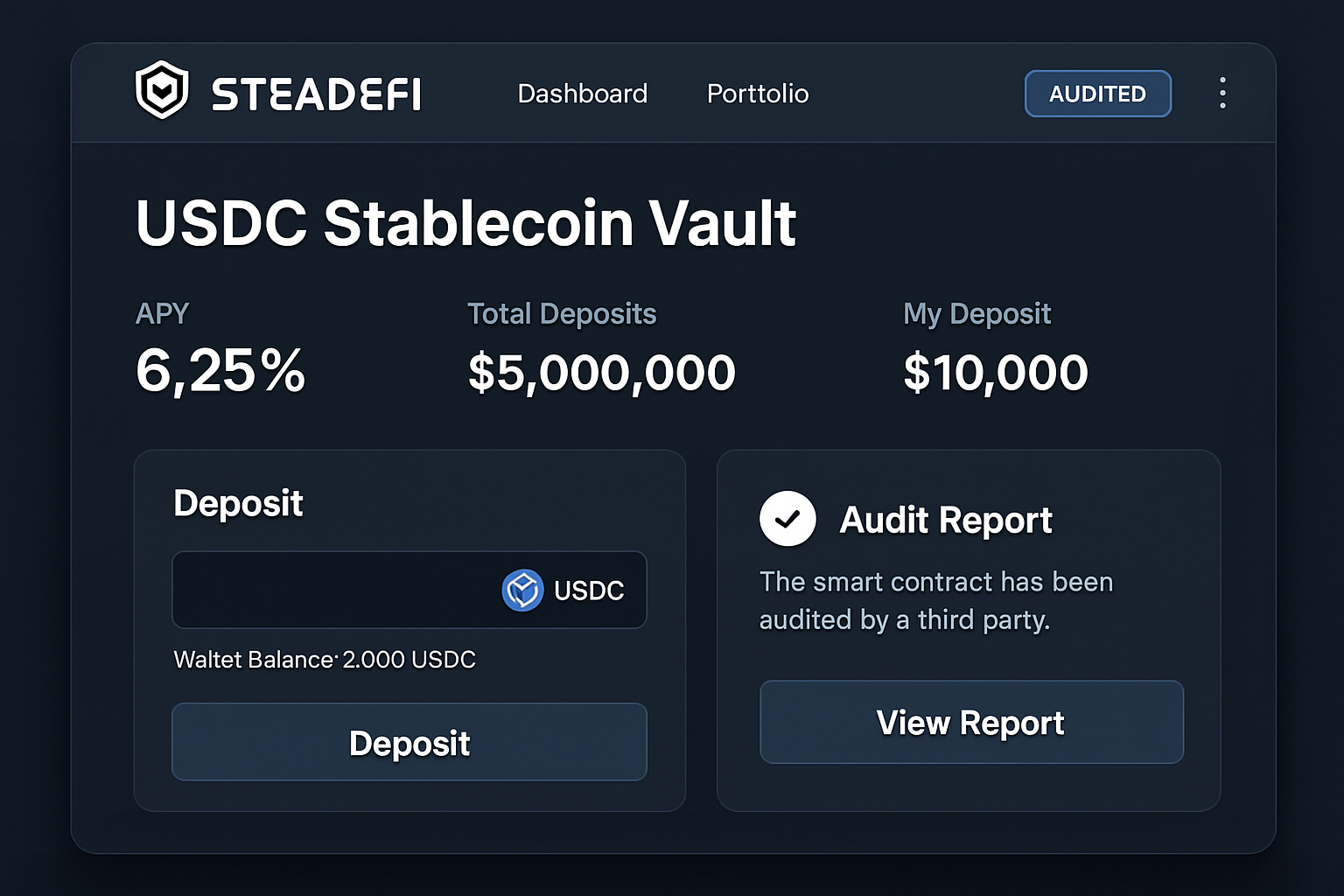

But not all vaults are created equal. A “battle-tested” vault is one that has survived real-world market volatility and undergone rigorous third-party audits. Platforms like Steadefi have set the standard by completing multiple security reviews with top firms such as Zokyo and Codehawks. Similarly, defi. money’s extensive audit trail is publicly available on GitHub, providing open access to every assessment and update.

This transparency is more than a box-ticking exercise – it’s essential for building confidence among DAO members and institutional participants who demand verifiable risk controls before entrusting millions in digital assets.

The Anatomy of Strategy Vault Transparency

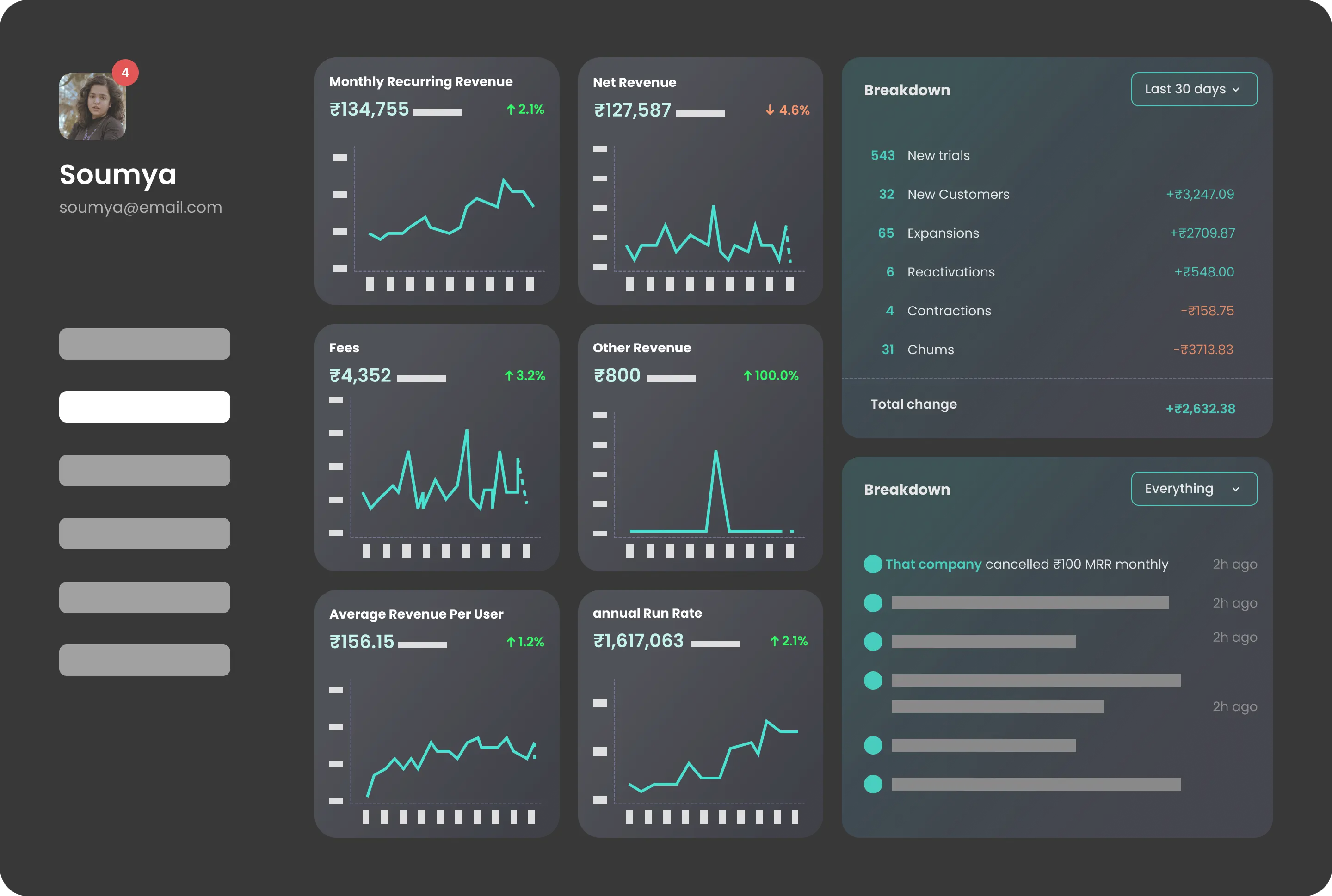

The move toward strategy vault transparency isn’t just about publishing audit reports. It’s about creating an environment where every action taken by a smart contract can be independently verified by the community or professional auditors. Open-source codebases allow anyone to inspect logic for vulnerabilities or backdoors. Standardized metrics like verifiable Total Value Locked (vTVL) provide real-time proof that assets are accounted for accurately – not just claimed via opaque dashboards.

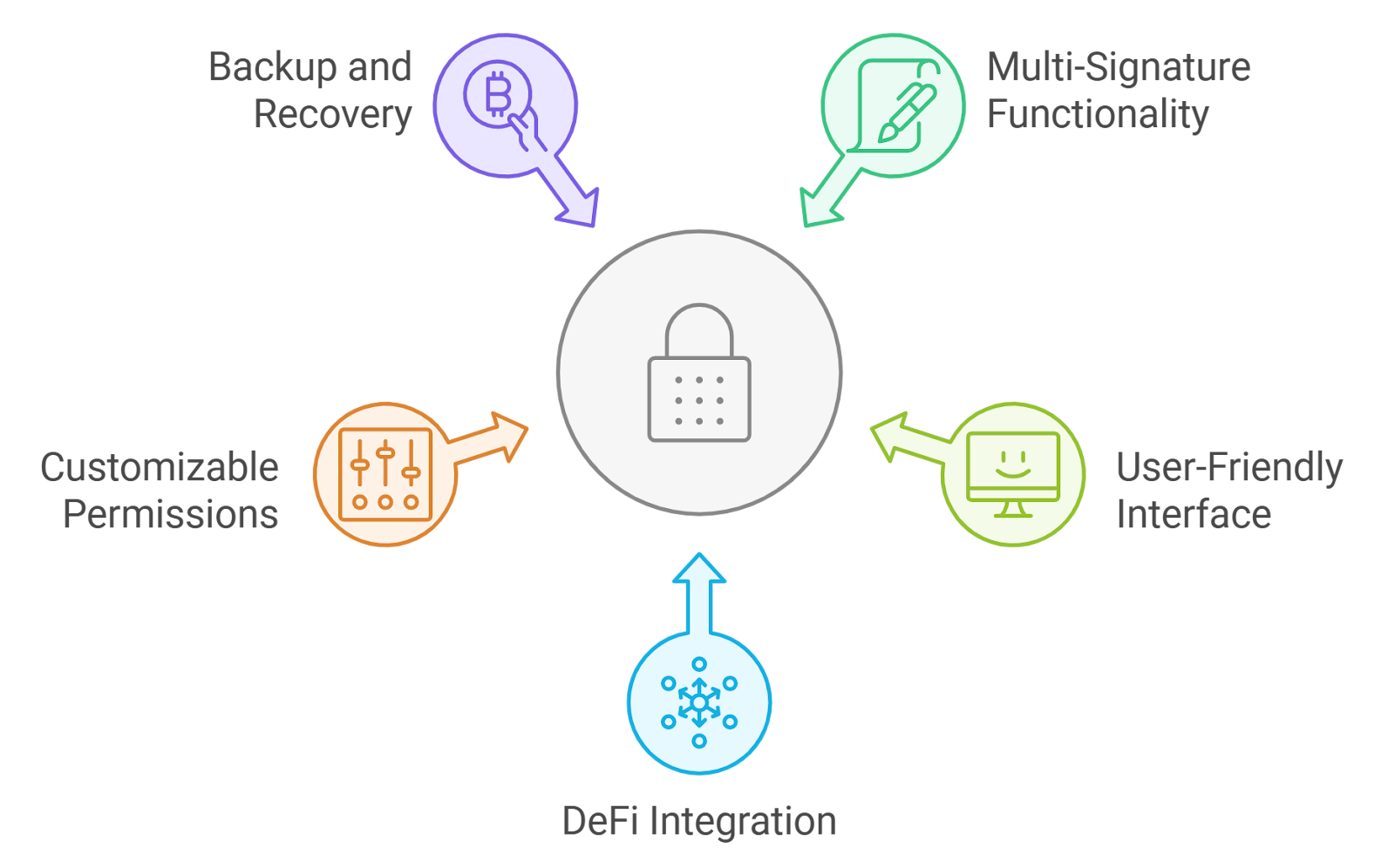

Key Features of Transparent DeFi Strategy Vaults

-

Open-Source Smart Contracts: Transparent vaults publish their smart contract code, allowing anyone to inspect, verify, and audit the strategies and logic that manage user funds. This open access is standard among leading platforms such as defi.money and Steadefi.

-

Third-Party Security Audits: Reputable vaults undergo rigorous, independent audits by firms like Zokyo and Codehawks (as seen with Steadefi), with audit reports made publicly available to verify the safety and reliability of the protocols.

-

On-Chain Transparency and Verifiable Metrics: Key data such as Total Value Locked (TVL) and strategy performance are published on-chain and updated in real time, with emerging standards like verifiable TVL (vTVL) enabling users to independently confirm asset balances and flows.

-

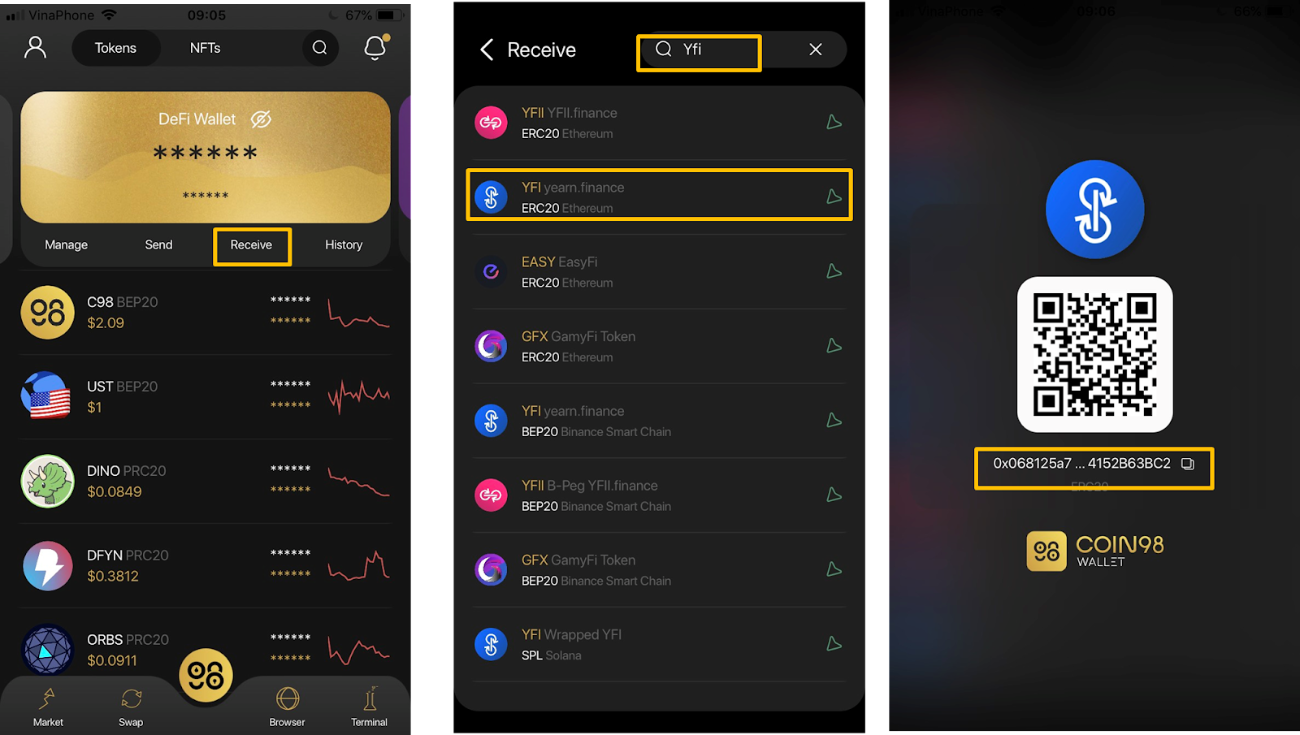

Permissionless Access and Non-Custodial Design: Transparent vaults operate without centralized control, allowing anyone to deposit or withdraw funds at any time, and ensuring users retain ownership of their assets. This is a core feature of protocols like Yearn Finance and defi.money.

-

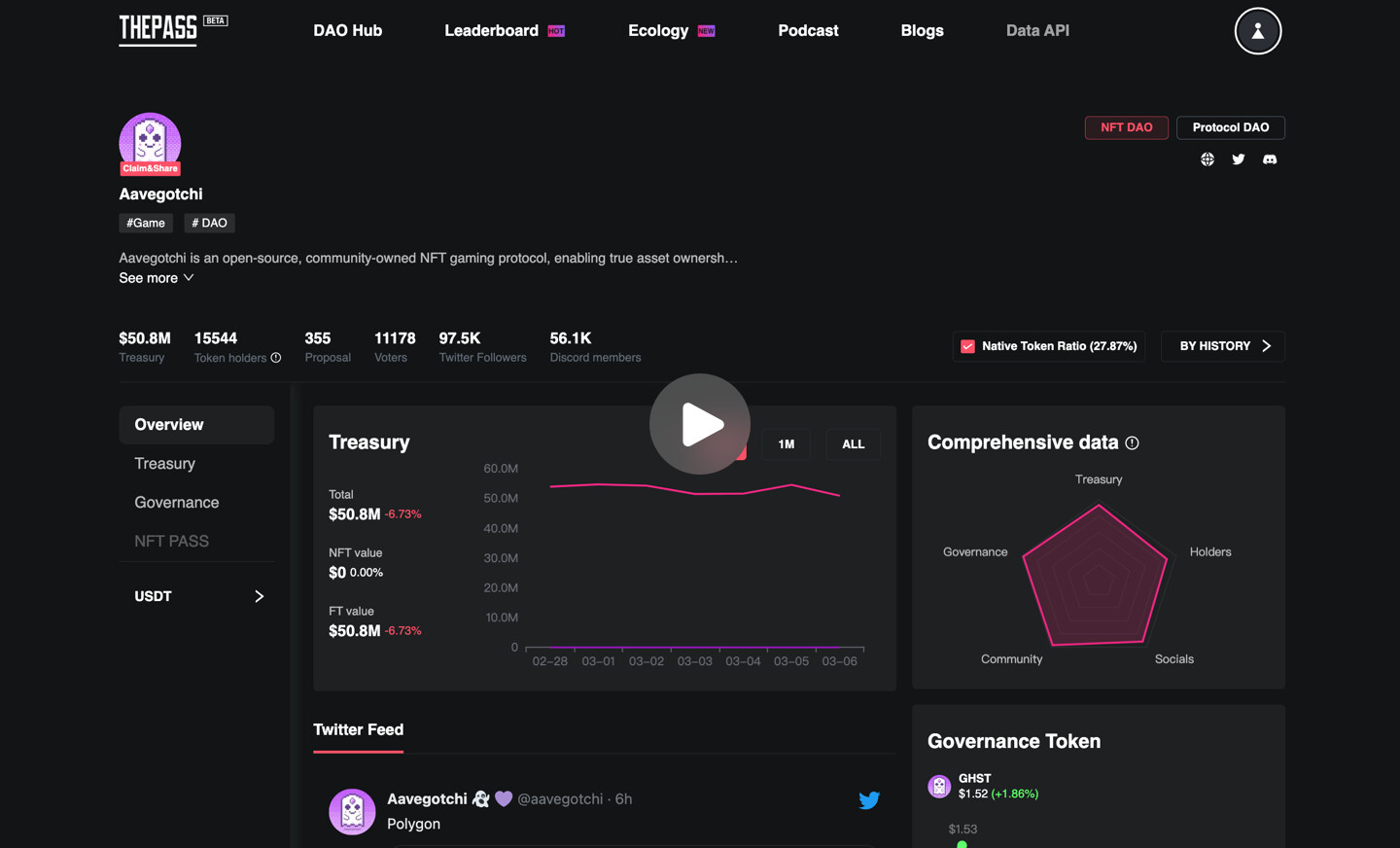

DAO Governance and Community Oversight: Many top vaults are governed by decentralized autonomous organizations (DAOs), where parameter changes, upgrades, and treasury flows are decided transparently by token holders. Platforms like Yearn DAO and Olympix exemplify this model.

-

Comprehensive Performance Reporting: Transparent vaults provide detailed, historical performance records and risk disclosures, enabling users to assess strategy effectiveness and risk profiles before depositing funds. Galaxy and defi.money both offer such reporting.

The best-in-class platforms further empower users with granular analytics dashboards tracking performance history, risk exposures, and fee structures. This level of disclosure transforms what was once a black box into an auditable engine room for DAO treasury growth.

Why Trust Still Matters in On-Chain Treasuries

The decentralized ethos promises trustless interactions – but paradoxically, DAO treasury trust remains one of the most critical hurdles in mass adoption. Even with permissionless architecture, users must still believe that smart contracts will execute as intended under all market conditions.

This is where independent audits play a pivotal role. By subjecting code to external scrutiny before launch – and after each major upgrade – teams demonstrate accountability to their communities. Notably, platforms like Steadefi have made all audit results public, setting a new bar for openness in an industry too often marred by rug pulls or silent exploits.

Ultimately, as DAOs evolve from experimental collectives into sophisticated asset managers, they’ll need more than clever yield strategies; they’ll need battle-tested infrastructure that can withstand both market chaos and adversarial attacks without compromising user funds or organizational reputation.

Importantly, the evolution of on-chain risk disclosure is not just a technical upgrade but a cultural shift. DAOs and DeFi treasuries now recognize that trust is earned through proactive transparency, not just passive compliance. This means regular updates on smart contract changes, clear communication of risk parameters, and a willingness to address vulnerabilities in public forums. The most respected teams don’t shy away from disclosing past incidents or near-misses; instead, they use these moments as proof of resilience and learning.

Security doesn’t stop at the audit report. Leading platforms are adopting continuous monitoring tools that alert communities to abnormal contract behavior or potential exploits in real time. This ongoing vigilance is especially crucial as vault strategies grow more complex, integrating derivatives, cross-chain bridges, and automated rebalancing logic. Each new feature introduces fresh attack surfaces, underscoring why DeFi vault security must be treated as a living process rather than a one-time hurdle.

The Future: Standardization and Community-Driven Assurance

The next frontier for audited DeFi vaults lies in industry-wide standards for both security and transparency. Initiatives like vTVL are only the beginning; we’re seeing calls for unified audit frameworks where findings can be compared across protocols, making it easier for DAOs to benchmark their treasury partners against objective criteria. Equally important is the rise of community-driven assurance programs, bug bounties, peer reviews, and real-time incident response teams that extend the safety net beyond what any single auditor can provide.

Essential DAO Practices for Robust On-Chain Treasury Management

-

Adopt Audited Strategy Vaults: Utilize vaults that have undergone rigorous third-party audits, such as Steadefi (audited by Zokyo and Codehawks) and defi.money. This ensures smart contract security and builds trust among DAO members.

-

Ensure Transparent On-Chain Reporting: Implement dashboards and tools that make all treasury actions, transactions, and performance metrics visible to members. Platforms like Dune Analytics and Nansen provide robust analytics for transparency.

-

Utilize Permissionless, Non-Custodial Vaults: Opt for vaults that are fully permissionless and non-custodial, ensuring DAO assets remain under decentralized control and reducing counterparty risk. Examples include Yearn Finance and Beefy Finance.

-

Standardize Metrics with Verifiable TVL (vTVL): Adopt metrics like verifiable Total Value Locked (vTVL) to provide transparent, on-chain proof of assets managed by the DAO, enhancing accountability and trust.

-

Implement Dynamic Risk Management: Engage risk curators or automated risk modules that continuously monitor and adjust strategies based on market conditions, as practiced by platforms like Galaxy and OlympusDAO.

This collaborative approach will be essential as TVL continues its meteoric climb, from $150 million to $4.4 billion in just one year, with no signs of slowing down. As more capital flows into programmable treasuries, the cost of failure rises dramatically; so does the competitive advantage of being able to prove your infrastructure is not only secure but battle-tested by independent experts.

For DAO leaders and crypto investors alike, the takeaway is clear: insist on transparency at every layer, from codebase to committee minutes, and reward platforms that treat audits as an ongoing partnership rather than a marketing checkbox. In this new era of decentralized asset management, trust isn’t given; it’s meticulously built, one line of code and one audit report at a time.